where does credit score start canada

Call 1-800-465-7166 for Equifax. A bad credit score is a score of 574 or less and means banks lenders landlords and even some employers will consider you less financially responsible than borrowers with a higher score.

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

The higher the score the better you are at repaying your debts.

. In both countries the credit scores are calculated off of five factors. If youve never had credit activity a credit card or. Your score is below average and lenders will see you as a risky borrower.

If you want to view your credit report online for faster access you have to pay a fee. 1-877-713-3393 Quebec residents Confirm your identity by answering a series. The credit score range in Canada is between 300 and 900 with the higher the better.

In Canada you will get credit scores as high as 900 points as a simple starting point. Your credit score doesnt start at zero and the lowest score you can have is 300. Instead it means that your credit score doesnt exist yet.

Banks credit unions and other financial institutions credit card companies car leasing companies retailers. 1-800-663-9980 except Quebec Tel. There are two main credit bureaus in Canada Equifax and TransUnion.

Call 1-877-713-3393 for TransUnion in Quebec. It tells potential lenders how well you manage debt and credit. The Meaning Of Credit Reports.

The R stands for revolving credit accounts that can carry a running balance on which you are required to pay only a portion each month. What credit score do newcomers in Canada start with. Most financial experts suggest a rate below 3040 positively influences your credit score.

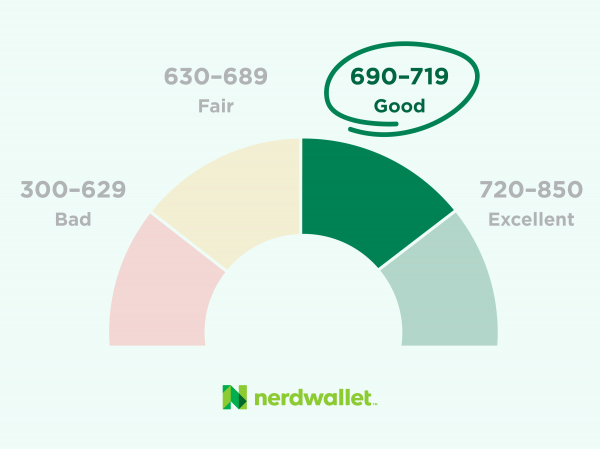

But most peoples credit scores start out around 500 or higher and the average score for all adults is 716. Equifax TransUnion These are private companies that collect store and share information about how you use credit. If you work on positive financial habits you can keep your credit score on the good side of the spectrum and even if it isnt right.

According to Equifax Canada one of Canadas major credit bureaus the average credit score amongst Canadians from 10 years ago to today has fallen in every age bracket but Generation Z ages 18 25. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a. Canada and the United States work on a similar credit scoring system issuing three-digit scores.

When Did Credit Scores Start In Canada. Money that doesnt belong to you. R1 is the best credit rating and R9 is the worst.

In TransUnions view a score that is above 650 will likely allow you to receive a standard mortgage loan while a score that is below 650 is likely to block you from receiving new credit insurance. Credit scores start at 300. However there are ranges that tell lenders if you are Poor Fair Good Very Good or Exceptional with credit.

850 is the maximum score. First introduced in 1989 by Fair Isaac and Company as well as Fair Isaac Corporation today Fair Isaac Corporation is regarded as one of the most important technology companies. Slightly above average and most lenders.

The longer youve been in good standing with your credit accounts the better for your credit score. Call 1-800-663-9980 for TransUnion except Quebec. In Canada scores range between 300 and 900 while in the US.

This is not the same as a poor or zero credit score. Call the credit bureau and follow the instructions. Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Who creates your credit report and credit score There are two main credit bureaus in Canada. These private companies only collect information about how you use credit. A credit score is a number on a scale of 300 to 900.

In Canada credit scores can be as high as 900 and as low as 300 but dont worry. Poor 580 or less. In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a kind of report card on how good you are at managing debt and financial responsibility.

To order your credit report by phone. On Canadian credit reports each credit account is assigned a credit score on a scale from R1 to R9. Your score is still below average but you may still get approved for loans.

They use this information to calculate your credit score which they store and may share with. The lower the score the. Paying your bills on time helps build your credit score.

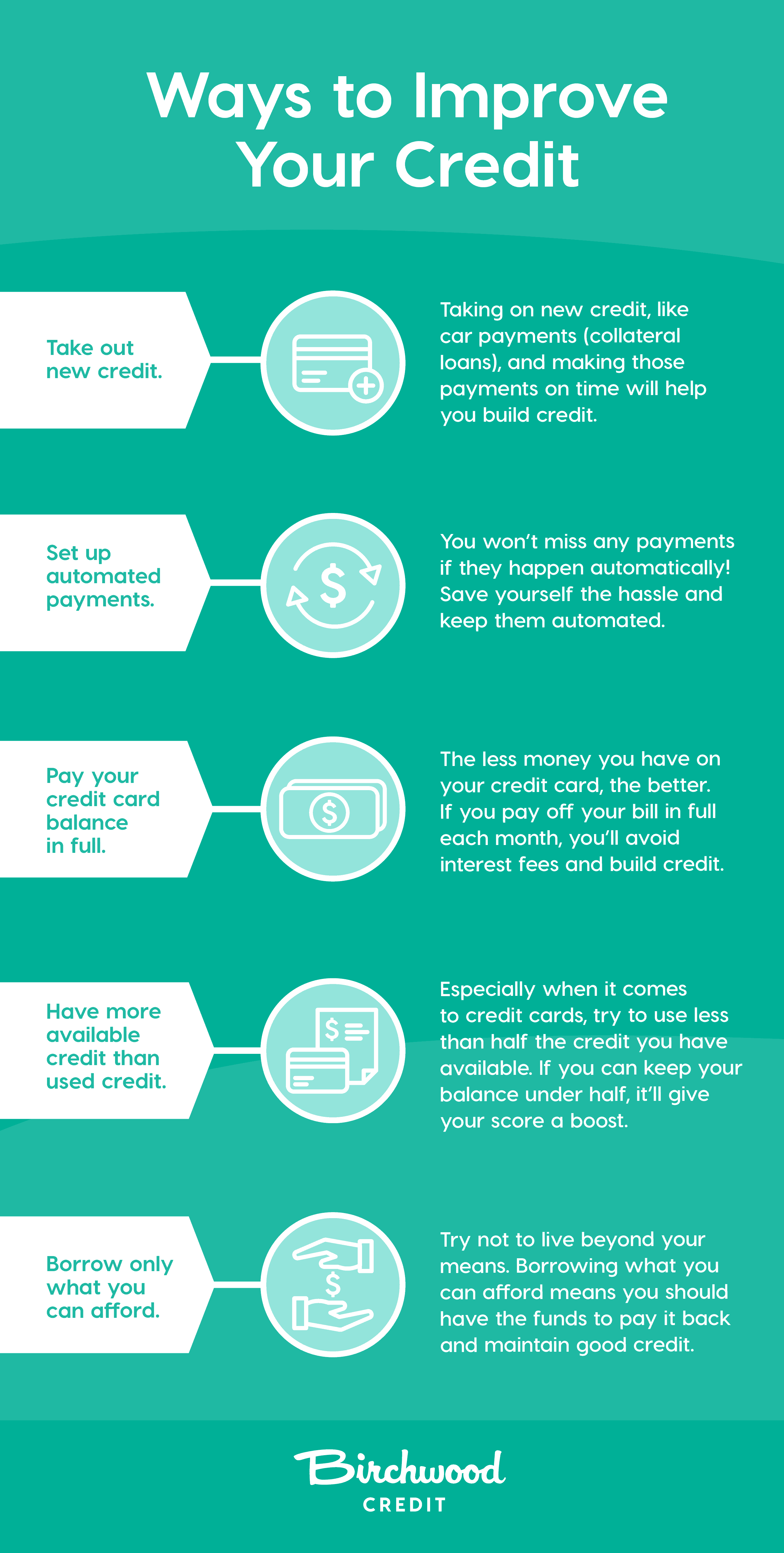

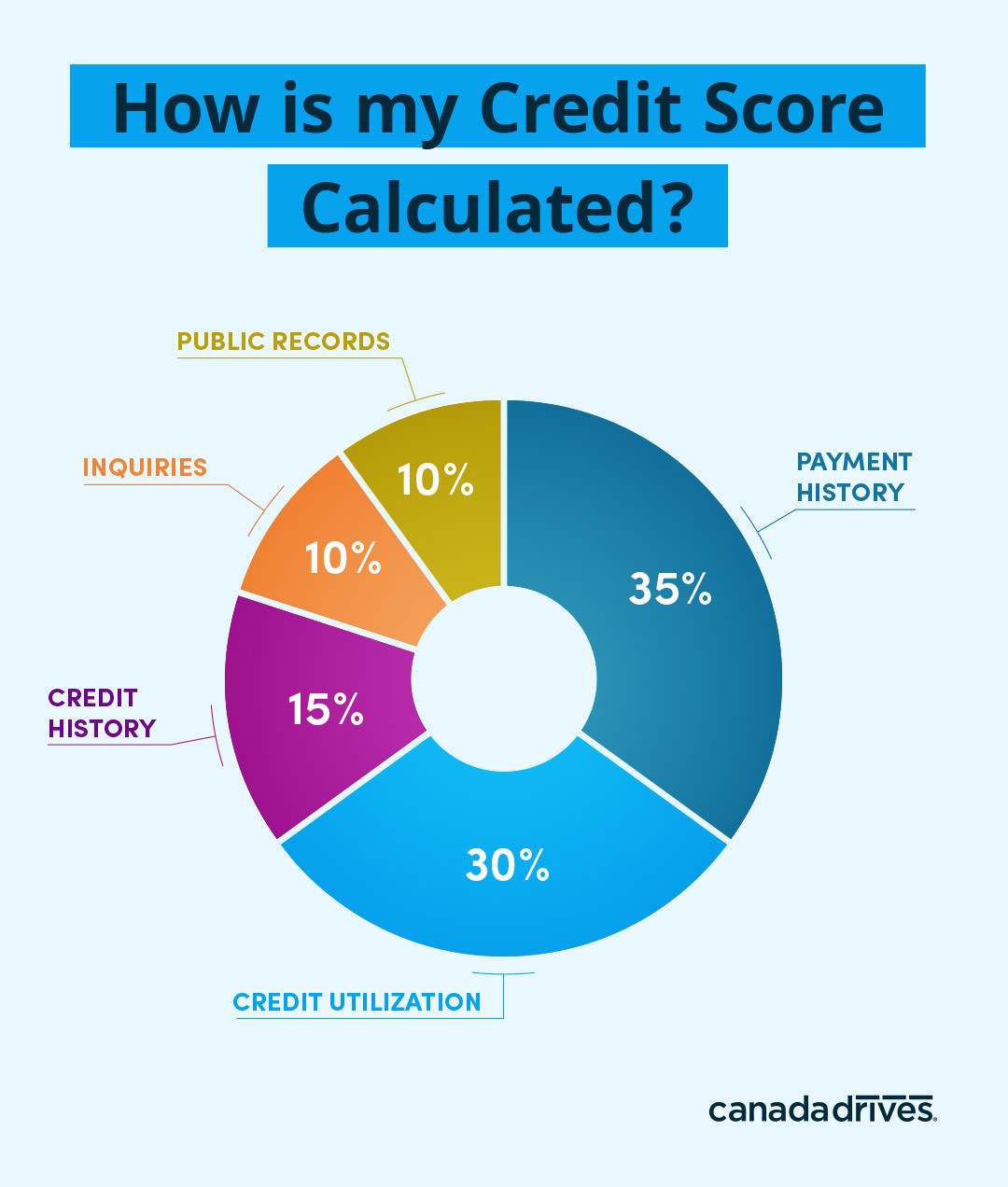

Payment History Debt Burden Length of History Types of Credit and Recent Searches. In Canada credit scores start at 300 and go as high as 900. Managing a variety of credit.

As soon as you establish credit your first credit score may range from 500 well in the 700s depending on how well you do as a borrower. When you first arrive in Canada you start with no credit score. This will change once you get credit from a financial institution and start using and repaying it.

Fico Credit Score Range Fico Credit Score Credit Score Range Credit Score

Credit Score Range What Is The Credit Score Range In Canada

Credit Score Range What Is The Credit Score Range In Canada

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

In Canada Credit Scores Range From 300 To 900 Where Your Number Falls In This Range Will Determine Whether Credit Score Range Credit Score Low Interest Rate

A Beginner S Guide To Understanding And Improving Your Credit Score Fix Your Credit Improve Your Credit Score Credit Repair

What Is A Good Credit Score Forbes Advisor

Everything You Need To Know About Credit Scores Canada Drives

Best No Annual Fee Credit Card In Canada For 2020 Award Seal Low Interest Credit Cards Best Credit Cards Miles Credit Card

Fico Credit Scores Approaching 850 Scores Series 3 A Good Secured Card Fico Credit Score Credit Card Tracker Credit Repair

Understanding Your Credit Score Is The Foundation To Your Financial Future Knowledge Is Credit Mortgageb Credit Repair Fix Your Credit Credit Restoration

What S Considered A Good Credit Score Transunion

600 Credit Score Is It Good Or Bad

8 Easy Ways To Increase Your Credit Score Fast In Canada In 2022 Improve Credit Score Improve Credit Paying Off Credit Cards

Everything You Need To Know About Credit Scores Canada Drives

:max_bytes(150000):strip_icc()/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)